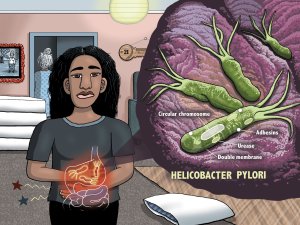

Academic pharmacist Nataly Martini provides key information on Helicobacter pylori pathophysiology, diagnosis and evidence-based treatment strategies to enhance patient outcomes

Beauty sector provides silver lining in dark COVID cloud

Beauty sector provides silver lining in dark COVID cloud

Vicky Morgan (IRI) looks at the many products within the beauty sector that are reporting impressive growth in sales at a time when other categories are free falling

Fragrance is now worth $28 million in Green Cross Health and independent stores

As New Zealand shoppers and businesses find their way through the perils of COVID19, the pharmacy retail business has also experienced one of its most challenging times in 2020 and 2021. Stores went through periods of minimal shopper presence, and retail business suffered. What was a $563 million industry 12 months ago, reported a decline of 7.9 per cent, down $44 million in the 12 months to August 2021.1

We saw the likes of the cold and flu and natural health categories plummet. However, surprisingly, the beauty and skincare categories have bucked the trend and reported a boost in sales.

The premium skincare and make-up sectors plumped up during this time, reporting growth of almost 7 per cent (up $3.1 million). In contrast to what we’ve seen in the past, and due to the borders being closed, export sales are not what is driving this growth. Export sales in these high-end categories have declined by 3.7 per cent versus the previous year, and now make up just 4.9 per cent of the total category value.

Premium skincare experienced growth of $2.5 million, up 7.8 per cent on the previous 12 months. The Lancôme brand was the major contributor, adding $2.4 million to the growth, followed by Estée Lauder.

Almost all the growth is driven by facial skincare products, with new products a driving factor. Chanel is also a stand-out performer with more than $600,000 of growth delivered by one particular product, Chanel Mousse Visage Cleansing Cream 150ml, the biggest contributor in this category.

Looking good online

The premium make-up category reported growth of 4.5 per cent in sales value compared with last year. Lancôme is again a star performer in this category and is the second highest growth brand. It added $309,000 to the category, slightly behind Benefit at $381,000. Eye make-up was the stand-out segment, adding $398,000 to the category, with Lancôme, Christian Dior and Benefit all adding value through new products.

As the country was plunged into lockdowns, with consumers forced to spend much more time at home, many Kiwis used the time to upskill their beauty regime – deprived of access to the professionals. Many bought beauty tools to create their DIY version. This led to a boost in sales in the beauty accessories category which reported growth of 2.4 per cent over the same 12 months. False lashes, face de-fuzzers and facial rollers drove growth of 8 per cent in cosmetic tools.

Sweet smell of success

Fragrances were the category that truly came up roses during this time, reporting startling growth of 18.4 per cent compared with the previous year. The category is now worth $28 million in Green Cross Health and independent stores.

New products have been a key driver in this category also, adding $4.6 million in value sales in the 12 months to August. Most notably, Giorgio Armani My Way EDP and Marc Jacobs Perfect EDP, added $500,000 across their size range.

Shoppers continue to buy their triedand-tested favourites also, with nine out of the top 10 products all reporting growth versus last year. The number one and two products, being YSL Opium EDT 30ml and Chanel Coco Mademoiselle EDP 100ml respectively. Both reported doubledigit growth.

Are shoppers turning to their local pharmacy stores now that overseas travel is restricted, and our duty-free stores closed? Or has fragrance become a small luxury during the pandemic that is affordable and a great mood booster?

Feel-good luxuries

Nailcare and nail polish also reported an uptick in sales. As homes became nail salons, many New Zealanders turned to their local pharmacy to enhance their colour range, and bought additional manicure and pedicure tools. The nail kits/tips segment grew by 23 per cent as press-on nails became even more on trend due to social distancing and salons being closed.

Are we witnessing “the lipstick effect” play out here in New Zealand? During hard times, economists have historically turned to this phenomenon.2 The theory is that even in tough times, people still make room in their budgets for small, feel-good luxuries – like lipstick.

Will we continue to see these beauty and skincare trends in the last months of 2021 and into 2022? And are there still more sectors which could experience an unexpected rise?

With mask wearing in New Zealand becoming mandatory at Delta Level 2, consumers might start thinking more about eye make-up, focusing on lashes and brows to enhance the only part of the face visible. Despite the economic challenges the country is facing, there is still plenty to be optimistic about in the sector.

Vicky Morgan is a retail account director for IRI New Zealand. IRI is a global data analytics and insights company working predominantly within the FMCG (fast-moving consumer goods) environment

1. IRI MarketEdge New Zealand Pharmacy (Green Cross Health and independent stores) data to 8 August, 2021