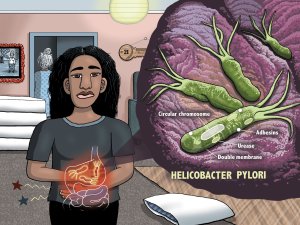

Academic pharmacist Nataly Martini provides key information on Helicobacter pylori pathophysiology, diagnosis and evidence-based treatment strategies to enhance patient outcomes

Chemist Warehouse to drop Ebos as supplier

Chemist Warehouse to drop Ebos as supplier

Pharmaceutical supplier Ebos is to lose a major customer, potentially knocking a $2.1 billion hole in its earnings.

Ebos said it had been told by the Chemist Warehouse that its supply contract will not be renewed when it expires next June.

Chief executive Officer John Cullity said it always knew contract renewal was a risk to its business.

"We have been developing strategies to minimise the earnings impact from this potential outcome and create alternative opportunities for growth."

Australian based Sigma recaptured the Chemist Warehouse contract it lost to Ebos in 2019, offering inducements including cash, shares, and options to buy assets as part of the deal.

Cullity said Ebos had a range of options to fill the loss of the contract and boost future earnings.

"We are confident in the growth strategies we have for both our healthcare and animal care sectors and in the overall diversity of the group's earnings

Cullity said future earnings would be driven by expanding its wholesale pharmacy services to other retail chains, as well as building its own TerryWhite Chemmart network of about 550 stores.

He said Ebos also had options for growing its medical technology distribution business, more supply to hospitals, including specialist drugs for serious illnesses, and increasing its sales of medical products and equipment.

The company was also a significant maker of supplier of pet food and other treats, with leading brands Black Hawk and Vitapet, which would also offer growth opportunities.

Cullity said Ebos would also look at making savings across the group.

The company's shares plunged close to 14 percent on the news to their lowest since December 2021.

Broking house Forsyth Barr has previously estimated the loss of the contract could hit Ebos revenue by about 12 percent and operating earnings by about 8 percent in the current financial year, but also lead to a quicker reduction in the group's debt level.

"We await more details from the company for the specifics around the financial implications but pleasingly Ebos has continued to diversify its business in recent years which helps mitigate the impact of this contract loss," equity analyst Matt Montgomerie said in a market note.

-RNZ National

For more news from around the country go to https://www.rnz.co.nz/