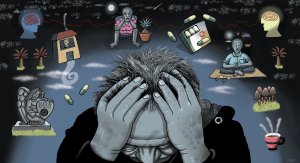

This article, written by Sidhesh Phaldessai, provides an overview of geriatric psychopharmacology, including the epidemiology of mental health disorders in the older population, the physiological changes that occur with ageing and their impact on pharmacokinetics and pharmacodynamics, and the use of psychotropic medications in older adults

ASX Announcement Blackmores enters into Scheme Implementation Deed with Kirin

ASX Announcement Blackmores enters into Scheme Implementation Deed with Kirin

This announcement was authorised for release by the Board of Directors of Blackmores Limited.

KEY HIGHLIGHTS

• Blackmores Limited (Blackmores) has entered into a Scheme Implementation Deed with Kirin Holdings Company, Limited (Kirin) for the acquisition of 100% of the issued share capital of Blackmores by way of a scheme of arrangement (Scheme)

• Under the terms of the Scheme, Blackmores shareholders will receive cash consideration of $95.00 per Blackmores share, less any special dividend declared or paid prior to implementation of the Scheme (Scheme Consideration)

• If the Scheme becomes effective, the Blackmores Board intends to declare a fully-franked special dividend of $3.34 per Blackmores share (subject to availability of franking credits)1 (Special Dividend) payable on or immediately prior to implementation of the Scheme, which is expected to enable eligible shareholders to benefit from franking credits of $1.431 per Blackmores share attached to any such Special Dividend

• Blackmores’ Board unanimously recommends the Scheme, subject to conditions outlined below

• Blackmores’ largest shareholder, Marcus Blackmore, who holds or controls approximately 18% of Blackmores’ ordinary shares outstanding as at the date of this announcement, has informed Blackmores that he has agreed with Kirin to vote 3,516,834 Blackmores shares held or controlled by him in favour of the Scheme, unless otherwise directed by Kirin

• The Scheme Consideration represents a 23.7% premium to last close, a 30.5% premium to the Blackmores one-month volume weighted average price up to and including 6 April 20232 and an implied acquisition multiple of 23.1x LTM Dec 22 EBITDA3

• The Scheme is subject to certain conditions, including informal clearance by the Australian Competition and Consumer Commission (ACCC), and approval by the Australian Foreign Investment Review Board (FIRB), and the State Administration for Market Regulation (SAMR) of the People’s Republic of China

• Blackmores shareholders do not need to take any action at this time

Blackmores Limited (ASX: BKL) (Blackmores or the Company) announced today that it has entered into a Scheme Implementation Deed with Kirin Holdings Company, Limited (TSE: 2503) (Kirin) for the acquisition of 100% of the issued share capital of Blackmores by way of a scheme of arrangement (Scheme).

If the Scheme is implemented, Blackmores shareholders will receive total cash consideration of $95.00 per share (Scheme Consideration), less any special dividend declared and paid to Blackmores shareholders on or before the date of implementation of the Scheme.

A fully-franked special dividend of $3.34 per Blackmores share (subject to availability of franking credits)4 (Special Dividend) is expected to be paid, resulting in franking credits of $1.434 per Blackmores share attached to any such Special Dividend.

DETAILS OF THE SCHEME CONSIDERATION

The Scheme Consideration values Blackmores’ equity at approximately $1,880 million5 , and at an enterprise value of approximately $1,840 million, and represents: • a 23.7% premium to the last close price of $76.79;

• a 30.5% premium to the 1-month volume weighted average price (VWAP) up to and including 6 April 20237 of $72.80;

• a 29.7% premium to the 12-month VWAP up to and including 6 April 20237 of $73.22; and

• an implied EV / EBITDA multiple of 23.1x Blackmores’ LTM Dec 22 underlying EBITDA.

BLACKMORES DIRECTORS UNANIMOUSLY RECOMMEND THE SCHEME

Blackmores’ Board of Directors unanimously recommends that Blackmores shareholders vote in favour of the Scheme, in the absence of a superior proposal and subject to an Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of Blackmores shareholders.

Each Blackmores Director intends to vote all of the Blackmores shares that he or she holds or controls in favour of the Scheme, subject to those same qualifications.

Blackmores Chair, Wendy Stops, said: “The Kirin Scheme represents an attractive, all-cash transaction.

The Blackmores Board believes the agreed Scheme Consideration represents appropriate long-term value for the Company and an attractive outcome for Blackmores shareholders.

The Blackmores Board has accordingly unanimously recommended that Blackmores shareholders vote in favour of the Scheme, subject to customary conditions such as independent expert conclusions and no superior proposal.”

Blackmores Chief Executive Officer and Managing Director, Alastair Symington, said: “Today is an important day in the history of Blackmores.

The Kirin proposal recognises the strong leadership position that Blackmores, through its brands and people, has established in the natural health sector across the Asia Pacific region over our long history.

Importantly it also confirms the significant opportunity that lies ahead for our employees and other key stakeholders of Blackmores as both companies come together to combine their focus on growing Kirin’s health science business across the world.

The combination of Kirin and Blackmores is testament to the clarity and ambition of our collective strategic direction and is recognition of the significant effort, and capital invested at Blackmores over the past 3 years in repositioning the business for sustainable profitable growth.

Kirin is a leading Food and Beverage, Pharmaceuticals and Health Science company, headquartered in Tokyo and listed on the Tokyo Stock Exchange with a market capitalisation of A$22.9 billion.

For decades, Kirin has sought to leverage its evidence based ingredient technology outside of its core beverage categories, and has increased its focus on health-related products.

The proposed acquisition of Blackmores will accelerate Kirin’s aspiration to become the leading health science company in Asia-Pacific.

The combined company will have a larger platform to further leverage the Blackmores brand, accelerate penetration into high growth Asian markets, and expand its presence into new geographies.”

Kirin President and Chief Executive Officer, Yoshinori Isozaki, commented that “Blackmores presents an exciting opportunity to transform the scale and reach of our Health Science domain.

Kirin Group is working to create social value and economic value by solving social issues through our business activities, and we have been transforming our business from a brewing business to the business model creating value across Food & Beverages and Pharmaceuticals domains, based on the concept of "CSV" (Creating Shared Value).”

Takeshi Minakata, Director of the Board, Senior Executive Officer, President of Health Science Business Division in charge of Strategy of the Health Science Domain said: “We believe Blackmores will accelerate the transformation of our Health Science Domain as both Kirin and Blackmores share a vision to improve people’s lives through our products as well as a commitment to quality, innovation and investment.

We are excited about the growth potential for the Blackmores business and look forward to supporting its growth and development, and furthering its commitment to quality ingredients and product development.

Kirin will continue to invest in Blackmores, its brands and its foundations in complementary medicine to accelerate its growth across the Asia Pacific region and globally.

We also recognise the strength and capability of the Blackmores team and will work with them to build on the proud legacy of the Blackmores business and to realise its full potential, whilst maintaining its headquarters and manufacturing operations in Australia.”